Welcome to the first MoneyNeverSleeps newsletter! If you’re reading this but haven’t subscribed, now’s the time to join!

Money going up like the stock market (oou)

Flipping big coins I bought a S10 Martin (skrt skrt)

I'm a hustler I be on the internet stacking

Soulja Boy (Bitcoin)

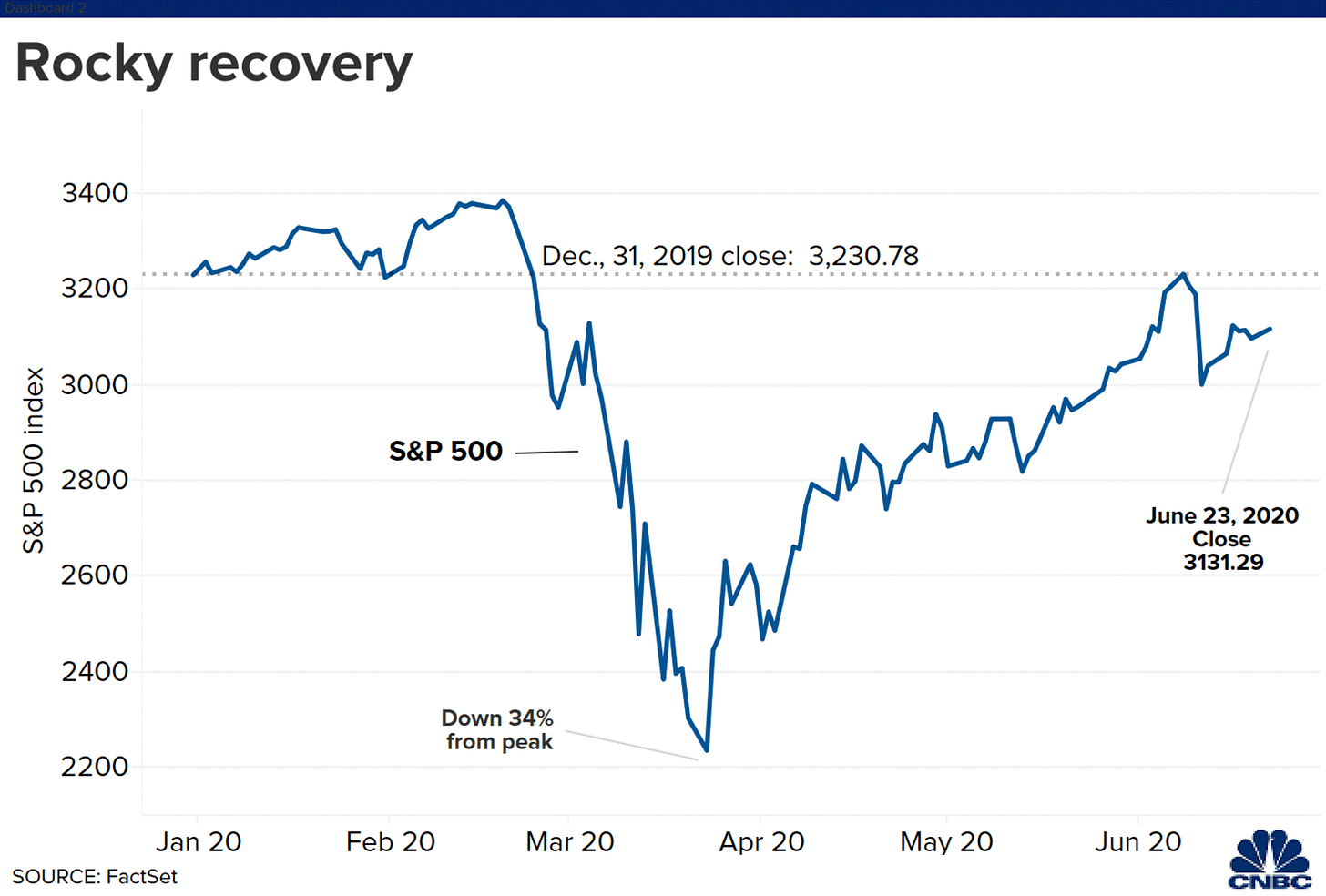

2020 has been the year that turned everything on its head and made us challenge conventional thinking on a whole range of topics. One of the many areas that has had a complete upheaval is the US Stock market

The US is in the midst of Great Depression-era levels of unemployment. The US economy in officially in a recession and more than 100,000 have died from Covid-19. Not to forget that the country is also in upheaval amid widespread civil protests.

And yet, the stock market marches ever higher.

The recent period of 50 trading days represented the biggest rally in the history of the U.S. stock index.

Some of the stranger headlines:

Hertz - announced it was entering bankruptcy and was met with a 10x increase in its stock from 56 cent on May 26th to $5.53 on June 8th

The US Global Jets exchange-traded fund, which allows investors to pool resources and buy US airline stocks, saw a phenomenal rise in investments. The funds' assets, which were $34.6 million on March 3, jumped to $615 million on April 30, representing a rise of 1600%

The market is acting at complete odds to the US economy that even the most experienced players are struggling to make sense of it all.

Several observers have criticized Warren Buffett, arguably the best value investor of all time, for Berkshire Hathaway’s recent underperformance. So far, Berkshire Hathaway is down 20.6% for the year, while the S&P 500 is down only 4.1%.

So what is driving the market positivity……

One school of thought is that it is down to increased levels of day trading from a younger generation of investors.

Enter Dave Portnoy, founder of Barstool Sports (a media empire of 41 podcasts with 8.5m+ monthly listeners) and an outspoken critic of Buffett.

Portnoy livestreams his day trading under the moniker ‘Davey Day Trader Global’, or #DDTG, and gets hundreds of thousands of viewers on Twitter and appears to revel in his role as the Pied Piper of this next generation of day traders.

Younger generations, who use their phones for everything, are comfortable dealing with trading apps, and companies like Robinhood Financial appeal to first-time investors with referral promos and free stocks when they sign up.

Robinhood added more than three million funded accounts in the first four months of 2020, and half of customers who opened accounts this year said they were first-time investors, with the majority aged 18-25.

This is reflected in another favourite of the Gen Z, Tik-Tok, where as of mid-June, the #investing tag had racked up 278.1 million views, while variations of investing (#investing tips, #realestateinvesting and #investing101) added up to millions more

Robinhood users have picked stocks from companies hit hard by the pandemic, such as those in the travel industry. Most interest has been in firms such as the American Airlines, Hertz, Delta, Spirit and Norwegian Cruise Line.

What could possibly go wrong by making it easier for the average person to invest in shares……

Let’s be clear, I am all for making it easier for people to invest and I recently started using the investing function of my Revolut account.

Learning to invest and understanding the markets are good things … to a point.

Making it easier for retail investors to invest in the stock markets is a good thing…to a point.

When financial services companies make something like trading so simple that it can be easy to make impulsive decisions and it clouds the waters between investing and gambling….that can be dangerous.

This was highlighted tragically last week by the suicide of a 20 year old US student, Alexander E. Kearns, who had been trading options on Robinhood and had mistakenly believed he had run up a negative $730,165 cash balance when he checked his account at close of trading on a Friday evening but did not understand that with option trading, it may not have represented uncollateralized indebtedness at all, but rather his temporary balance until the stocks underlying his assigned options actually settled into his account bringing the balance back to positive.

When you make a trading platform look and feel similar to Instagram or other social media sites, you run the risk that users do not understand the impact of their decisions.

When:

Confetti falls to celebrate transactions

The user interface looks like you are playing Candy Crush

You gamify the process (Robinhood has a waitlist of over 500k people signed up fr it’s upcoming high-interest current account & users can tap a button up to 1000x per day to improve their position on the waitlist)

You risk creating an addictive product and addictive behaviour.

Portnoy has been quick to point out that he started investing as a replacement for his regular sports betting and is upfront about the fact that he is not a financial advisor nor should people follow his investing advice. The sports-betting industry in the US was a $150 billion business in 2019 and gamblers have since March been limited to wagering on any available obscure sport, causing many of them to turn their focus to the financial markets

Some additional data on the surge in online trading:

Excessive trading may be triggered by an addictive process.

12% of all trading activity is from day-traders, yet day-traders are only 1.6% of all profitable traders.

Men trade more than women, and unmarried men trade more than married men.

Stock market crashes have been linked to upticks in suicide.

Investors with a large differential between their existing economic conditions and their aspiration levels hold riskier stocks in their portfolios.

I’m afraid Robinhood and others might become an addictive platform — the equivalent of Instagram for trading.

Tell me why I’m wrong…

Eoin

Wirecard and the money that never was

Who:Wirecard is a German payments processor, which offers companies services allowing them to accept credit cards and digital payments like Apple Pay or Paypal in stores, online or on mobile. Wirecard claims around 300,000 firms worldwide. Wirecard has until recently been one of Europe’s most valuable fintech companies.

What: For the past 18 months, the Financial Times has reported on whistleblower allegations of accounting fraud at what was once Europe’s most valuable financial technology group. On June 18th, Wirecard was advised by its auditors that €1.9bn of cash was ‘missing’. Wirecard has since announced that the missing cash never existed and Markus Braun, the CEO (who resigned when this came to light), has since been arrested for fraud.

How: Wirecard had previously said that the cash was held in two banks in the Philippines. The central bank of the Philippines denied the claim and said documents suggesting this were forged and an employee at each bank has since been suspended pending investigation.

The bigger picture: History is littered with cases of corporate fraud and there are a lot of similarities with the Wirecard case and the Enron scandal, with Wirecard being referred to as the ‘German Enron’.

What the Wirecard scandal raises is the issue of who is responsible for the regulatory oversight? BaFin, the German financial regulator, have been quick to point out that it had oversight only of Wirecard Bank’s banking arm, and not Wirecard the ‘tech company’. Germany is not alone in highlighting this distinction. Regulatory oversight of the fintech industry is not all encompassing, and many financial activities do not fall under regulated activities. Tech companies moving into offering financial services products on the periphery, and at scale, generally do so due to the lighter regulatory oversight, which allows for speed of going to market.

That particular piece may be the lasting effect of the Wirecard scandal.

Eoin

Left Field

How do I describe ‘Left Field’? It’s a place to put the content (newsletters/articles, etc) that we have amassed over recent weeks or previous years that really make us think or change our thinking on a particular topic. All the content will offer an alternative view of some topic in financial services, technology or sport (or a combination of all three!)

Jonathan Lebed's Extracurricular Activities

This week’s article is an old favourite of mine from one of my favourite authors, Michael Lewis, and very relevant in terms of the larger discussion around investing.

In 2000, the SEC in the US settled a case against a 15 year old high school student for stock market fraud. Between September 1999 and February 2000, Jonathan Lebed had purchased stock and, using Yahoo Finance messaging board and fictitious names, had recommended the stock to others. The S.E.C. said that his posts had triggered chaos in the stock market. The average daily trading volume of the small companies he dealt in was about 60,000 shares; on the days he posted his messages, volume soared to more than a million shares.

Jonathan made approx. $800,000 over the 6 month period and settled with the SEC for approx. $300k meaning he walked away with approx. $500,000 profit.

Some interesting questions that this raised that are still relevant 20 years later:

What is legally was wrong with broadcasting one's private opinion of a stock on the Internet?

How is what Jonathan Lebed did different from what Dave Portnoy/Davey Day Trader is doing now?

Can anyone really claim to understand the stock market and ‘market forces’?

Is it a simple case that ‘stocks respond to publicity’?

Check out our podcast episode ‘The Prediction’ where we spoke in detail with Andrew Mullaney about the impact of perception on stock prices.

Anyway, enjoy the article and feel free to get in touch to discuss more!

- Eoin

Can’t Sleep??

MoneyNeverSleeps podcast episodes from this month:

ep 91: Money Talks #17: Speeding up the Enterprise Sales Cycle with David Vatchev from R3

ep 90: Money Talks #16: WhatsApp, Backstage Capital, Revolut & Olivia

Podcast Recommendation: Invest Like the Best – “an open ended exploration of markets, ideas, methods, stories and of strategies that will help you to better invest both your time and your money”. The weekly podcast is hosted by Patrick O’Shaughnessy, one of the best prepared and thoughtful interviewers I’ve come across. After most episodes, I feel like Neo from the Matrix waking up after Tank implanted the martial arts module into his brain….“I know Kung Fu”.

Book Recommendation: An Astronaut’s Guide to Life on Earth – Chris Hadfield - “What Going to Space Taught Me about Ingenuity, Determination, and Being Prepared for Anything”. Reading this taught me to set the bar high and overprepare – if you do that, you can not only survive, but excel in new situations.

Article/Newsletter Recommendation: if you haven’t heard of it already, check out Morning Brew for a daily email on tech and emerging tech. Predominantly US focussed but an entertaining review of major tech news stories

This newsletter has been written by Eoin Fitzgerald and Pete Townsend

Want more MoneyNeverSleeps?

Check out the MoneyNeverSleeps Podcast available on all the main podcast channels.